MEIS Scheme (Merchandise Exports from India Scheme)

What is MEIS Scheme? - An Overview

The Merchandise Exports from India Scheme (MEIS Scheme) is an export incentive scheme introduced under the Foreign Trade Policy 2015-20, which came into effect from 01.04.2015 and will be valid until December 2020. MEIS Scheme was introduced with an objective to promote the export of goods from India by providing incentives in the range of 2-7% of the FOB value of exports for notified/specific products. By providing these incentives, MEIS Scheme aims to make Indian goods competitive in the global markets by offsetting infrastructural inefficiencies and associated costs involved in exports from India.

The emphasis is given mainly on the products which have higher export intensity, has an excellent capability to generate employment in the country and enhance the competitiveness of Indian goods in the global market.

The MEIS Scheme Provides incentive in the form of a Duty credit scrip or MEIS License which can be used in payment of import duties or can be sold in the open market for a premium rate.

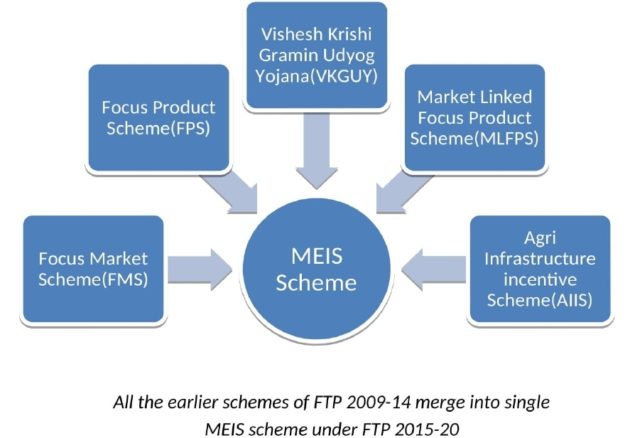

There were five schemes – Focus Market Scheme, Focus Product Scheme, Vishesh Krishi Gramin Udyog Yojana, Market Linked Focus Product Scheme, Agri Infrastructure incentive scheme under Foreign Trade Policy (FTP) 2009-14 which was replaced by MEIS Scheme. All the above five Schemes merged into a single MEIS Scheme, which removes various kinds of restrictions and significantly enlarges the scope of export incentive schemes present in earlier FTP.

The MEIS scheme benefits are permitted to exports made by Special Economic Zone(SEZ) units also, which were not allowed in the previous export incentive schemes. Exporters can avail of the benefits under this scheme on the export of the eligible goods only notified as per the Appendix 3B.

Recent Updates

- 9th April 2021: DGFT has opened the MEIS application window for the FY 2019-20 & A relaxations given in the Late cut provisions for the exports made in the FY 2019-20 –

DGFT has opened the MEIS application window for the FY 2019-20 which was blocked due to the non-availability of funds, and also notified that the MEIS applications can be submitted without any late cut for the exports made in between 1st April 2019 to 31st March 2020 upto 30th September 2021 i.e. If shipping bills are submitted on or before 30th September 2021 no late cut would be applicable for the exports made in FY 2019-20. - 1st September 2020: Cap on MEIS benefits on the exports made from 01.09.2020 to 31.12.2020 Total reward granted under MEIS Scheme shall not exceed 2 Cr per IEC on the exports made in between 01/09/2020-31/12/2020. IEC holder not having the export between 01/09/2019 – 31/08/2020 or any new IEC issued on or after 01/09/2020 would not be eligible to file application under MEIS Scheme on the exports made with effect from 01/09/2020, DGFT may change the aforesaid benefits cap to ensure that total claim amount does not exceed the allocated amount as the Government approved only Rs 5000 Cr for the total claim under MEIS.

- 27th July 2020: The online module for MEIS Applications has been blocked for Shipping Bills with Let Export Date (LEO date) from 01.04.2020 onwards due to the non-availability of funds – The Department of Revenue had allocated 9000 Cr. for the MEIS Scheme for a period from 01.04.2020 to 31.12.2020. However, after checking the MEIS Scrip issuance database, the Commerce Ministry has indicated that as on 20.07.2020, MEIS Scrips of value Rs. 422.4 Cr has already been issued to exporters for shipping Bills with Let Export Date (LEO date) from 01.04.2020 onwards. Therefore to keep a cap on further issuance due to the low allocation of funds, the Ministry has blocked the Online MEIS module. The Ministry of Commerce has requested the Department of Revenue and also written to the FM to increase the allocation from the current 9000Cr. There is no reply from the FM yet.

- 31st March 2020: Public Notice Number 67/2015-20

The Foreign Trade Policy 2015-20 has been extended from 31st March 2020 to 31st March 2021, and the MEIS scheme is extended till 31st December 2021; due to Coronavirus outbreak, The Government may consider the continuation of Scheme till 31st March 2021. - 13th March 2020: The Union Cabinet approved the RODTEP Scheme (MEIS Scheme Withdrawal)

The Union Cabinet on Friday approved the Remission of Duties or Taxes on Export products, and this Scheme will replace the Merchandise Export from India Scheme (MEIS) that was found to violate the WTO norms, MEIS will be phased out.

Who is eligible for MEIS Scheme?

The following is the eligibility criteria for MEIS Scheme:

- All the Exporters from India, be it a merchant exporter (trader) or a manufacturer exporter who are exporting the products that are notified in the Appendix 3B – MEIS Schedule are eligible to claim incentives under the MEIS Scheme.

- Eligibility depends only on the product exported, and not on the country of export, since as per latest circulars, MEIS Scheme is eligible for all countries.

- SEZ Units & EOU Units are also eligible to claim benefits under the MEIS Scheme.

- There is no minimum turnover criteria to claim MEIS.

- Goods exported through e-commerce platforms via courier are also eligible.

- Country of origin of the exported products should be India, re-exported products are not eligible.

- Only those Shipping Bills are eligible for MEIS Scheme in which there is a “Declaration of Intent” & Scheme reward option is ticked as “YES”.

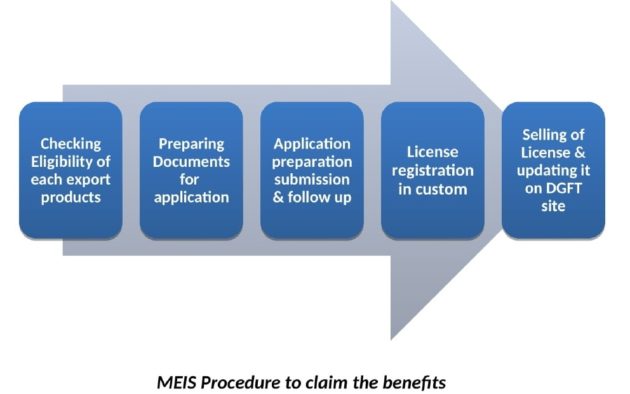

How can we assist you in claiming the MEIS scheme benefits from DGFT?

- Consult our clients about the benefits they can avail of on their products by checking their eligibility.

- We assist our clients in the preparation of documents in providing hassle-free services.

- Prepare and submit online applications to obtain the License under the MEIS scheme.

- Registration of the License done in custom from our office.

- We also assist in the selling of licenses, provide help in documentation for the transfer of a license to the buyer.

- Also, do the online transfer by recording the details on the DGFT website.

List of Services AFLEO Consultants DGFT Regional office

- IEC and its modification/Yearly Update/IEC Surrender.

- Revoke IEC from DEL, Suspension, Cancellation etc / Merger/Demerger of IEC’s.

- DGFT Identity card.

- Advance License – Issuance and Redemptions

- Export Promotion Capital Goods (EPCG) License – Issuance and Redemptions

- Duty-Free Import Authorization (DFIA)

- Remission of duties or Taxes on Export Product (RoDTEP)

- Merchandise Export from India Scheme (MEIS).

- Services Export from India Scheme (SEIS).

- Rebate of State and Central Taxes and Levies (RoSCTL)

- Transport and Marketing Assistance (TMA)

- Certificates of origin (COO) – SAPTA, APTA, ISLFTA, GSTP, India-Dubai CEPA etc.

- Import Monitoring System – (Steel Import Monitoring System, Coal Import Monitoring System,Copper/Aluminium Import Monitoring System, Chip Import Monitoring System)

- Deemed Export Benefits – Apply for Refund of TED/DBK/Brand rate Fixation.

- Star Export House Certificate.

- Free Sale & Commerce Certificate, End User Certificate.

- Enforcement cum Adjudication Proceedings at RA Mumbai.

- E-RCMC Certificate from DGFT – APEDA, FIEO, EEPC, PHARMEXCIL, CHEMEXCIL ETC.

- Gems & Jewelry Schemes.

- Application for Interest Equalization Scheme.

- REX Registration.

- Abeyance Cases for IEC’s in DEL.

- FREE SALE AND COMMERCE CERTIFICATE.

- END USER CERTIFICATE.

DGFT HQ, New Delhi

- Norms Fixation – Handling 25+ Norms Fixation cases every month across various Product groups. (Engineering, Pharmaceutical, Chemical, Textiles & Leather, Plastic & Rubber, Food, Sports & Misc. products)

- Policy Relaxation Committee (PRC Matters) – Proudly representing 20+ cases every month.

- EPCG Committee Approvals – Handling 10+ complex cases every month.

- Permission for Restricted/Negative list of Import Items & Export Items – Experience in Handling 100+ cases till date.

- Registration Certificates for Export & Import Items.

- SCOMET Licenses.

- TRQ (Tariff Rate Quotas)

- Appeal Matters under FTP.

Custom Related Services

- AA/EPCG/DFIA License Registration.

- Bond & Bank Guarantee (BG) Cancellation of EPCG/Advance License.

- ICEGATE Registration.

- Refund under Section 74.

- Pending Duty Drawback from Customs.

- Factory stuffing– Self-sealing permission. [FSP]

- Pending IGST Refund from Customs.

- Removal of IEC from Alert list of Customs.

- GST Services – Refund of ITC from GST.

- Authorized Economic Operator (AEO T1, T2 & T3) certification.

- Reply & Follow-up of Customs Notices if any.

- GST Services – Refund of GST for Service Exporters.

- AD Code/IFSC Registration.

- SIIB Matters (Special Investigation and Intelligence Branch)

- SVB Matters.

- Registration Procedures for First time Importers/ Exporters

- DPD/DPE Registration.

Other Certification:

- All Types of Digital Signature Certificates.

- Health Certificate for Export Products

- EPR Certification for Producers, Importers and Brand owners.

- Phytosanitory Certificate.

- BIS Certification.

- Banking & RBI related liaison for Exporters & Importers.

AFLEO logistics

- Sea Cargo Consolidation – Import & Export

- Sea Freight Forwarding – Import & Export

- Air freight – Import & Export

- Land freight

- Warehousing

- Customs clearance

- Insurance

AFLEO Global

- Buying of scrips – MEIS / SEIS / RoDTEP / RoSCTL / DFIA

- Selling of scrips – MEIS / SEIS / RoDTEP / RoSCTL / DFIA

Find our brochure for more details:

Fill the below form to get in touch with us

Nature of rewards under the MEIS scheme

The Incentives are given to Exporter under the MEIS scheme in the form of Duty Credit Scrip or License, which are freely transferable. In case the holder of License wishes to sell the License, he can sell them to anyone who wishes to buy the License for a waiver of their import duty.

MEIS rates

Under the MEIS scheme, the benefit is calculated as a percentage of the FOB value of export for notified goods exported into notified markets.

The incentives given under the MEIS scheme vary from product to product and from country to country. The reward rate is specified in Appendix 3B of FTP, which is categorized according to ITC(HS) code. MEIS rate of rewards varies from product to product and is in the range of 2% to 5% for most items. In some cases 7% also.

As per the recent amendment, country-wise differentiation has been done away by extending the market coverage to all countries for MEIS incentives.

Want to know the MEIS Rates for your Export Product? Just fill the below form and our team will get back to you with the latest rates within 1 hour.

Ineligible categories under MEIS scheme

There are the following export categories that are ineligible under the MEIS scheme.

- Supplies made from Domestic Tariff Area (DTA) to Special Economic Zone (SEZ) units.

- Export of imported goods covered under paragraph 2.46 of FTP.

- SEZ /EHTP/EOU/ BTP /FTWZ products exported through DTA units.

- Exports initiated by units in Free Trade and Warehousing Zones (FTWZ).

- Deemed Exports.

- Export products which are subject to Minimum export price or export duty.

- Exports through trans-shipment, meaning thereby exports that are originating in the third country but trans-shipped through India.

- Red sanders/beach sand

- Gold, Silver, Platinum

- Diamond or any other precious metal in any form and other precious and semi-precious stones.

- Crude or Petroleum products of all type and all formulation

- Cereal (all types)

- Ores and concentrate of all types and in all formations

- All Sugar type and all the form of sugar

- Export of Meat & Products of Meat

- Export of milk and it’s products

How to use Duty credit scrip under MEIS?

Duty credit scrip obtained under the MEIS Scheme can be used in the payment of following Import Duties – Basic Customs Duty, Safeguard Duty, Transitional Product specific safeguard duty, Anti-dumping Duty only. It cannot be used for the payment of 18% IGST.

If the License holder does not intend to use the MEIS license for any of the given purpose then he can sell it in open market. MEIS Scrip can be sold at discount to the face value of license & can be sold directly to the buyer or through an agent who will help to find a buyer.

For example – If you have Duty credit scrip worth Rupees 2,00,000 it means it can be used to pay duties equivalent to Rupees 2,00,000. If the holder does not intend to use the scrip he can sell it in open market. The person who wishes to buy the license will not pay 100% face value of the license obtained under the scheme. He may buy the scrip for a discount @97% of face value i.e. at Rupees 1, 94, 000 instead of Rupees 2, 00, 000. But still it has the face value of Rupees 2, 00, 000 and it can be used for the payment of duties equivalent to Rupees 2, 00, 000.

In this transaction, Benefits to the buyer – He saved Rupees 6,000 in the given transaction as instead of paying Rupees 2,00,000 he only needs to pay 1,94,000. Benefits to the seller – Seller can en-cash the MEIS License and get the money directly in his account, which was otherwise of no use to him.

The Validity of the MEIS Scrip is 24 months from the date of issue. Revalidation of Duty Credit Scrip is not permitted under the MEIS scheme, and it should be valid on the date on which actual debit is made.

Documents required for MEIS Scheme Application

The following are the documents required for MEIS Scheme:

- Shipping bills

- RCMC (Registration Cum Membership Certificate)

- EBRC (Electronic Bank Realization Certificate)

Document preparation and gathering all the data needed for MEIS Application is an important task, and we have a separate team for each job to give our 100% efficiency. For submission of an online application under MEIS scheme, DGFT Digital Signature Certificate is also required.

We have an in-house team to prepare DGFT DSC and RCMC to avoid any kind of delay in the process of obtaining the MEIS License.

How to apply for MEIS Scheme / MEIS License Online? – MEIS Scheme Procedure

- Online Application shall be filled on the Website of DGFT (www.dgft.gov.in ) with the help of Digital Signature Certificate. Applicants need to select Online E-com Application under Services Tab from the website.

- The Online Application should be filled as per the form ANF-3A, the relevant shipping bills & e-BRC should be linked with the online Application.

- The Application can be filled with up to 50 shipping bills in one Application.

- Applicants are not allowed to manually feed the details in online applications for EDI shipments.

- Let Export Order is the date taken for determining the rate of the benefits of the products.

- The DGFT shall process the Application submitted, and Scrip shall be issued after due scrutiny of electronic documents.

- The Documents are required to be retained by the applicant for a period of 3 years from the issue date of License. DGFT may call for these original documents any time within three years.

- The above procedure is followed for claiming incentives under the MEIS scheme in all cases except in case of export of goods through e-commerce.

MEIS Scheme for export of goods through courier or foreign post offices using e-commerce

- The Goods exported by courier or foreign post office through e-commerce mode are eligible for MEIS Incentives.

- However, FOB value of goods up to Rupees 5,00,000 per consignment are only permitted for benefits under the MEIS scheme.

- If FOB value is more than Rupees 5,00,000 per consignment, then the benefit would be limited to the FOB value of Rs. Five lakh only.

- The Foreign Post Offices at New Delhi, Mumbai, Chennai are used for the manual mode of export of the goods.

FAQ's

According to Foreign trade policy, merchandise export is the export of goods manufactured in India.

Merchandise Exports from India Scheme (MEIS) is the additional export incentive

scheme under which Credit Scrip or MEIS License is issued as a reward against eligible

exports.

The working of the MEIS Scheme can be explained in 5 simple steps, 1. Eligibility – Check that your product is eligible for MEIS benefits and check what is the rate of incentive; 2. Online Application – Prepare all the documents and make an application; 3. License Issuance – DGFT will issue MEIS License or raise a query; 4. License registration at Customs – Register the MEIS license at Customs; 5. The sale or use of License – Use the MEIS licence to pay your import duties or sell it in the open market and en-cash it. Please find the detailed explanation below:

- Eligibility: For making shipping bills eligible for the MEIS scheme benefits, the scheme

reward option should be mentioned “YES” on the Shipping bills. - Online Application: Online Application needs to be done on the DGFT website; relevant details shall be filled online with the help of shipping bill, e-Bank realization Certificate, and RCMC copy.

- License issuance: DGFT will process the Application and issue the License within a week.

- License registration: License registration is done at Customs, which takes two working days.

- Selling of License: The License can be used to pay import duty, or it is transferable and can be sold in an open market with a premium rate.

All the goods Exporter, exporting products manufactured in India are eligible for

MEIS Incentives.

Under the MEIS Scheme, the benefit amount is calculated as a percentage of the FOB value

of eligible export.

Duty drawback enables Exporter to obtain a refund of customs duty paid on

imported goods, whereas MEIS is the additional export incentive given as 2% – 7% on FOB

value of eligible export.

Merchandise Exports from India Scheme (MEIS) & The Service Exports from

India Scheme (SEIS) are the two schemes under the Foreign Trade Policy 2015-20 for giving

incentives to the goods exporter and service exporter respectively in the form of duty credit

scrip.

The MEIS License is the Duty Credit Scrip obtained under MEIS scheme.

Reward under MEIS scheme can be claimed by filling online Application on

DGFT website and submitting all the required documents, and We are the team of DGFT

professionals having expertise in this domain from last ten years, Exporter only has to give us

documents and rest of the things will be taken care by our executives.

MEIS rate determines the quantum of reward given to the exporters. It can be

calculated as % of the FOB value of exports.

MEIS rate can be checked on the DGFT website

http://dgftebrc.nic.in:8090/dgft_meis/homepage.jsp by just providing the eight-digit HS code

and product description. Before application submission, we provide our clients with an excel

sheet containing all their products and corresponding MEIS rate of benefit.

Yes, MEIS Benefits can be availed for the last three years, i.e., shipping bills are eligible

for the Application of last three years from the LEO date mentioned on the shipping bills with

Late Cut clause.

Application shall be filed within a period of 12 months from date of Let Export

Order (LEO) or three months from date of uploading EDI shipping bills onto DGFT site by

customs without Late Cut.

In case, exporters do the delay in filing of the Application under MEIS scheme of more than

12 months from the Let Export Order (LEO date), then they are imposed of Late cut clause,

and it is given as follows:

The Government fees of Rupees 1000/- need to be paid online while making

Applications on the DGFT website.

It takes seven working days to get MEIS scrip from DGFT, and we try to do it

within 2-3 working days by avoiding any kind of delay in the application process.

The Government of India announced the discontinuation of MEIS & approved a new scheme,

but the FTP 2015-20 is extended till 31st March 2021 due to Covid-19 Pandemic, under the

extended policy exporter can continue to avail the MEIS benefits till 31st December 2020 it

may extend till 31st march 2021.

MEIS Scheme has been replaced by Remission of Duties or Taxes on Export Products

(RoDTEP Scheme), implementation of the scheme will be done in a phased manner.

Yes, MEIS License is transferable. The License can be transferred from owner to buyer.

The Selling of License means to transfer the Scrip from owner to buyer.

For ease of doing business, DGFT had started an online platform to transfer Scrip from seller

to buyer by using DGFT Digital Signature. After the transfer process buyer can utilize the

same for the import duty payment.

As per the latest notification, the Validity Period of MEIS License is 24 months from the date

of the issue of License.

The MEIS Scrip should be utilized within the validity period, the scrip can be considered as a

piece of paper once the Validity gets expired and revalidation of the scrip shall not be

permitted under the MEIS Scheme unless it has expired in the custody of any Govt.

Authority.

MEIS Scrip holder can use the MEIS license for the waiver of customs duties or if he does not intend to use he can sell it into the open market at discounted rate.

MEIS License is issued by DGFT and used at Customs. Hence Customs authority need to

verify it to check its genuineness. MEIS License registration procedure is done at customs

where Exporter needs to provide an issued license to the custom, and after verification, it can

be used for waiver of duty.

Yes, It is mandatory to register the MEIS license at Customs to verify the genuineness of

License /scrip from DGFT.

Yes, MEIS License can be sold in the open market.

Yes, We at Afleo Consultants help our client in the selling of License without any hidden

cost by following a transparent procedure of selling.

As per updated notification, GST is not applicable to the sale of the MEIS License

No, the MEIS Scrip cannot be used for payment of IGST.

Why Afleo Consultants?

- We are the team of highly qualified & experienced professionals having sufficient expertise over the years in the field of DGFT Consultancy Services.

- We only have the goal of providing very reliable services with the most competitive cost to the exporters under one roof.

- We keep updating our clients with regular policy amendments, all the upcoming rules, and regulations in foreign trade policy.

- We have a separate team for follow up with DGFT and have a great understanding of the working of DGFT office, which helps us in obtaining MEIS licenses without delay.

Fill the below form to get in touch with us

Our presence on Youtube

Our Office

- Unit No. 207, Centrum IT Park, Wagle Estate, Thane West, Mumbai, Maharashtra 400604

Drop a Line

- You may contact us by filling in this form any time you need professional support.

Afleo is a professional consulting firm providing consulting, documentation and representation with authorities for exporters and importers, global or international companies with business interests in India.